When the Dip You Want to Buy Never Comes

Bull markets are easy, but you will be left on the sidelines if you overthink things.

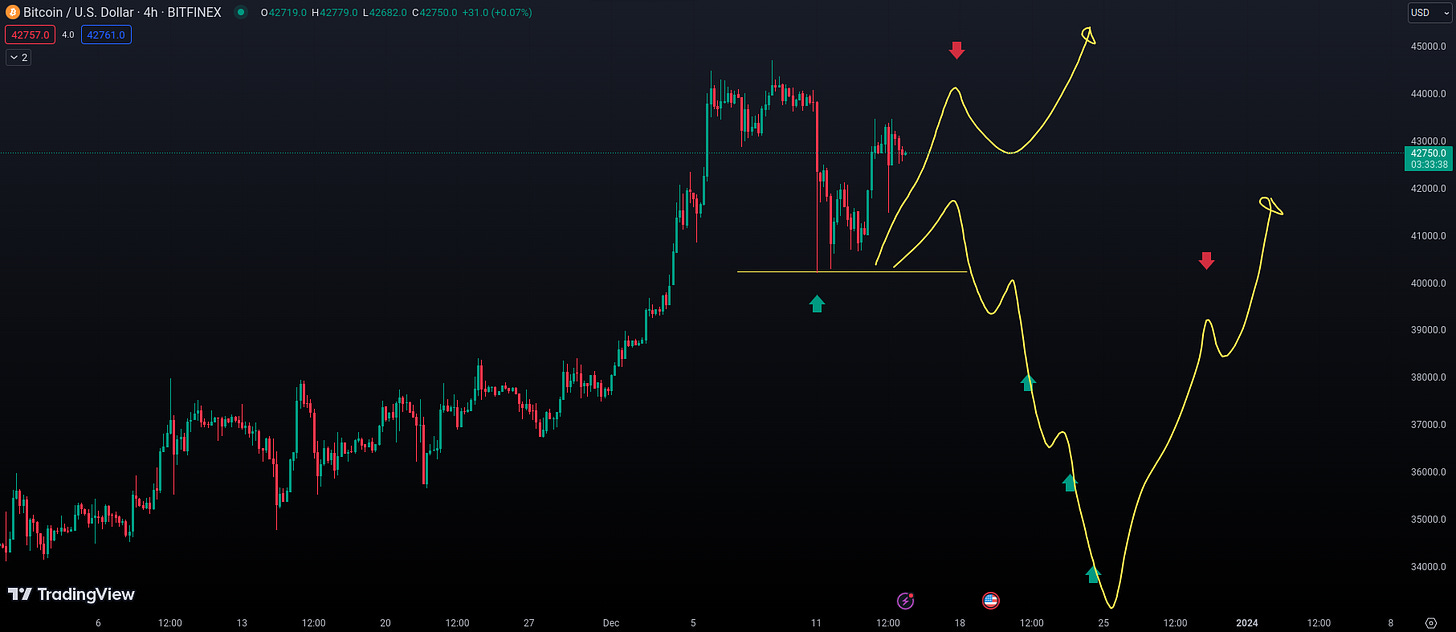

The last article talked about buying dips, especially on Bitcoin. Today, I wanted to talk about those pesky instances when the price more or less only goes up, giving no proper dips to buy (20-30%).

This leaves a lot of people on the sidelines.

I’m often one of them, as I like to buy dips, not rips—red candles, not green ones. Staring at the charts, marking out levels, and never seeing them get hit can be frustrating. Staying in cash while the rest of the world makes money and bragging about it is a painful, albeit quite normal, experience.

So what can you do when the price doesn’t want to dip low enough for you to feel comfortable buying and getting on board the bull trend?

You can take the risk and buy at the slightest dip, hoping and praying that this was the dip, as shallow as it was. Hoping and praying is not a sustainable trading strategy, though. Sooner or later, you will be wrong.

If you thought being stuck on the sidelines was painful, try being underwater (in paper loss) for an extended period: weeks, months, or even years. I’ve been there. A lot. On both sides of the coin. I prefer being in 100% cash to losing 20, 30, 50, or more percent of my portfolio while waiting to be rescued by the market. By far.

Watching all of my work and capital being eaten away by a relentless bear market in 2018 was a living nightmare. And this (below) was Bitcoin. I was actually trapped in some forgotten altcoins that went to zero and got delisted.

The point is things can and do go wrong.

Lessons were learned in that era, which is why I’m always banging on about managing risk. It doesn’t necessarily mean using stops, as good position sizing is the far better option, but you must manage risk somehow. Otherwise, you will eventually join the countless ranks of blown-up traders and investors who lost it all.

Below are two examples where, even if you had bought the exact bottom of the dip, you were trapped for months underwater (in loss). But since you were restless, you didn’t wait for the big dump, you bought the first 10% dip. Imagine the pain of having to endure what followed!

Nothing goes up in a straight line forever.

But it does feel like that sometimes. Buying dips entails three potential problems:

The dip may never come. Not to your desired level. You may be stuck for weeks or even months with no realized buys.

The dip eventually comes, but the bull trend is over by then. You didn’t buy the dip. You bought the first leg of a bear trend.

The dip comes, but it’s more volatile than you first anticipated, so you either chicken out (especially if accompanied by a proper fear campaign), or you load up too fast and have to watch the price dip lower or liquidate your position (using cross margin) if you were being brave with leverage.

How do we get around these problems?

First, we must know whether we are still in a bull trend. The problem is that we can’t see the future. We can only make estimates and adapt as new information comes in. It’s okay to have conviction in a trading idea, but it’s not okay to go bankrupt when it doesn’t play out! Always manage risk and expect the unexpected.

Dip your toes in the water.

See if it's warm and inviting, and only then add more risk (buy more). Don’t go all in on the first buy.

Buy a little, and watch the price either go down further, stick around the same level, or bounce hard. Depending on the reaction, you may now deploy more capital or cut the trade for a small loss.

The best decision you can make is to stick to smaller positions.

I know it sucks when you have a small account, but it beats losing what you have by being too greedy and impatient, speaking as someone who has lost it all more than once. I was a bold trader, but now I’ve become arguably overly careful. The price of old wounds, I suppose.

If you feel the need to buy, and you don’t get quite the dip you were looking for, buy a little. Get your feet wet. See where that takes you.

Happy no matter what

One of the earliest philosophies I learned in trading was to always be in a position where you’re happy regardless of what the price does. How is that possible?

The idea is that you buy when you want, but only with a small portion of your trading or investing account. Let’s say you buy 10% of your desired position.

If the price goes lower and you still want to buy, you have the capital to buy more - you’re happy as you’re getting an even better entry.

If the price pumps from your buy, you’re at least making some money. You can then hold on to the trade, ride the trend, or sell at a small profit. Either way, you’re happy as you made some money.

It was a good philosophy, and it almost eliminated the stress of trading, especially when accompanied by a sound trading strategy in which all of your decisions (entries, reasons, and exits) are well-defined ahead of time.

The downside was that you never made as much money as you theoretically could and that when you bought too soon, adding to your buys on the way down, you were risk-wise in some dangerous territory.

This problem was solved by newer going all-in, and if you were wrong on the idea, cutting the trade on the first bounce to minimize losses. Failure to do so could get you in a world of hurt.

To conclude, the dip may or may not come, so:

Have a plan, and dip your toes in the water. Buy a little and see where it leads.

You’ll feel better for having alleviated some pressure, and you’ll be in the game. Add only if it was a part of your initial plan or if the price warrants it.

If you eventually get your desired dip, you still have the capital to deploy and buy it. If it doesn’t dip further, at least you bought some and can now reap profits or build your position further.

If the dip turns out to smell of bears (bear market), take the loss and get the hell out!

Good luck out there.

Thank you for reading. I like you. Subscribe, and I’ll deliver new stories to your mailbox free of charge. If you enjoyed this article, help spread the word and remember to like, share, comment, cross-post, and restack the post. Follow this LINK if you want to do more. You are appreciated.

*New to trading? Start here and learn about managing risk!