The Importance of Discipline and Consistency in Trading

Even the best trading systems can't help you if you don't execute them perfectly.

This February was one of those months that would have been best overslept as far as markets are concerned. At least for me, that is. All the money I’ve made in the beginning of the month, I’ve returned by the end of it, plus some change. Just one of those unavoidable things in trading. Such periods do come and go, from time to time. Periods where everything that you do seems to backfire. All your stops are taken out only for your ideas to play out perfectly afterwards. None of your trades work out the way they usually do. All adjustments are futile.

This month was a month of confusion in the market and in the minds of traders. Flipping from long to short. Are we now in a bull market or are the bears still right behind the corner? Is it all just a silly range and everyone is losing their minds over nothing? Are we going to 30k or 10k USD per one Bitcoin? Which is it?

Such poor performance in one's trading makes you question your skills as a trader, your systems and your ability to make a living from trading.

Even traders who have been in the game for years can still fall into this trap of self questioning. I know I do and I’m no spring chicken. So if you happen to find yourself in this camp, you can perhaps find some comfort in knowing that you’re not alone. If however this was a triumphant month for you, congrats!

This all reminds me of the famous quote:

Ever since I’ve started getting serious about trading I’ve been plagued with one seemingly irrational constant - my system was positively printing money when back-testing, but I struggled with making any headway when trading my actual money.

Through relentless analysis and testing I’ve come to a realization that the problem is never really in the system that I trade, but in my execution of that system!

Here’s what I’ve noticed with myself (perhaps it will shed some light for you as well):

My systems work best when they are done completely unemotionally, without contemplation on their success, avoidance of losers and overextending winners in back-testing. I simply open each and every trade like a robot. When a trigger is present, a trade is open. Entry, stop and exit all clearly defined and perfectly executed.

I don’t interfere with my trades in back-testing. It’s the perfect example of “set and forget” approach. Once the trade is set, it either reaches its target or gets stopped out. No meddling whatsoever.

I open every single trade idea I see, as I’m not afraid of losing money on a weak trading signal, which is definitely not the case when trading my own money.

The winners take care of the losers in any larger sample size. I’m talking anything over 20 trades and this system practically can’t lose. There are episodes of 3 to even 7 losers on a bad week in back-testing, as they are in real life, but the difference is that in back-testing that doesn’t dismay me from taking the next trade, and the next, and the next… while in real trading, those losses add up and I back off the throttle in my trading. Sometimes I completely stop trading for weeks at a time.

There are periods when most trades I take in real trading end up losers and most of the ones I don’t take, but should per my system, end up being winners. Because I stop trading, stop executing my system when times get tough, I don’t collect all the winners I could and end up with much less profit or even loss as a result in the end.

In back-testing or paper trading as I prefer to call it, I’m the God of trading, the infallible master of markets, a money printer personified, but when it comes to trading my own money, the one I need to pay the bills, I am anything but!

Years into trading I still occasionally allow my fears, doubts and emotions in general to get the better of me. Maybe not in the catastrophic way I used to, meaning I don’t allow myself to take on larger loses by not having a stop, removing them or taking on too much risk, but emotions ruin my game-plan nonetheless.

If you ever catch yourself in one of these darker periods, where doubt and fear takes over, when nothing seems to work no matter what you do in the market, I would suggest the following:

Take a break and get your mind straight. Look back at all the success you’ve had in the past. If you could do it then, you can do it now, when you’re even more experienced than before!

Accept that you’ve had a bad day, week, month, even year. Analyze if you could have done something better and try to determine how to better navigate such conditions in the market in the future.

Back-test your systems thoroughly and on a large sample size. Take the time to do it right. It’s the best way I know of regaining confidence in your system. When you see it working in theory and when you see that even in the bad periods, the winners take care of the losers and that even in back-testing there are indeed such periods, you’ll find the courage and discipline to follow through with your system.

Reacquaint yourself with the fact that no system is perfect (and no trader) and that no system works all the time. There will be times when it simply will not work as intended and that’s OK. Persevere through these periods, contain your losses and your proper mindset so that you may take proper advantage of the better times ahead. They’re coming. The question is if you’ll be there to harvest them and if you’ll have any money or willpower left by then.

Trading is not a job, you don’t get a salary every month just for showing up. There are periods when you’re making a lot of money and there are periods when you’re losing money. It’s not easy because of its impact on our mind and emotions.

If you are to make it as a trader you’ll be doing more self analysis, self therapy and self improvement than anyone else. You’ll have to battle your demons over and over again, until they vanish from whence they came. You’ll have good days and bad days, and you’ll experience the extremes of both ends of the stick. The highs so intoxicating you can lose your mind and the lows so dark you risk losing your life.

Trading is simple, but not easy. This is best illustrated with trading a simple, yet proven trading system. You’ll learn the system and you’ll see with your own eyes that it really works over a larger sample size (this is important). When back-testing it will make sense and you’ll feel like this game is easy now. You simply wait for the right signals in the market, the right structure or whatever it is that triggers your particular trading system and bam, money in the bank. But then you’ll face the reality of emotions and their effect on every single one of us. That’s when the real work begins.

Trading is indeed simple, or can be simple, but we inevitably make it difficult, almost impossible because we simply aren’t robots and never will be. As much as I dislike algorithmic trading I can indeed see the power in having an army of “robots” executing your trades, taking out the human side of the equation.

Remember: any trading system is only as good as the trader executing it. The best system will do you no good if you’re not going to execute it with perfect discipline, objectivity and consistency.

You can make money on the simplest of systems, something like long support, sell resistance, and with a favorable risk to reward ratio, over a large enough sample size you should be making profit. The key to success lies in the execution of it all.

Perhaps in trading we shouldn’t be asking ourselves how to make AI (artificial intelligence) more like us, but how to make ourselves more like robots. Funny how that works, isn’t it?

Before I go, you want to see what a bad month looks like?

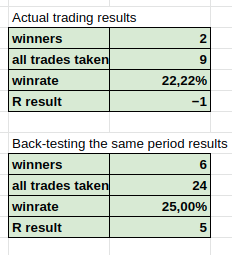

Below are the results of my trading in February and then a back-test of the same period. Both are horrible (average expected win rate otherwise is 40-60%, 1/4 risk/reward ratio targeted) and while I ended the month with a loss of one R (risk per trade) overall, if I had traded my strategy properly, I would still make 5R by the time it was over. Even in this abysmal example of a month, mindless back-testing still wins over the thinking monkey trying to be a smart ass.

I sure hope you did better, friends. Onward!

Disclaimer: nothing here is financial advice, just a fellow trader meditating on his trading journey, sharing the lessons he learned and debating some personal opinions that are only that, opinions and nothing more.

This newsletter is supported by you, dear readers, no one else.

I invest a lot of time and effort into writing this content and I do not get paid for my work. If you enjoy reading this newsletter and would like to support my work you may do so in one of the following ways:

- Share this content.

- Become a free or paid subscriber of the Newsletter.

- Become my Patron (tip jar)

- Buy me a cup of coffee with Bitcoin.

Bitcoin wallet: bc1qc60qsgtwzhgv3nnxvx6jlsuxh2zh55x3s4fv7w