Re-Frame Taking Controlled Losses as Good

Is accepting small losses really a good thing? How does one learn to accept them internally? - Mind of a trader series

In the previous article of this series we have talked about why it’s so important to make peace with taking small losses and never letting them grow into big ones. In this post, we’ll be focusing on the how.

As traders, we have to find a way to re-frame taking predefined and limited losses as “good trading”. Overwrite the existing programs of

“losing money (lost trades) = always bad” and

“making money (trades won) = always good”.

A good trade can still lose money and a bad trade can still make money. Counterintuitive, I know.

The key is in interpreting the quality of our trades by the process, not the result.

Did we have a good trading idea when we opened the trade?

Did we follow our plan?

Did we execute our trading strategy flawlessly?

Did we define our invalidation and take the loss if it came to that?

Did we define our take profit point and actually closed our trade there?

Did we follow our trading rules?

Monetary success comes as the result of good trading - the process.

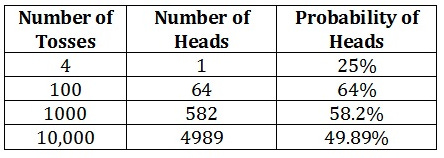

Think of trading as a coin toss.

The probability of one outcome over the other for the next toss is impossible to determine, right? But we do know that over a large enough sample size, the probability of heads and tails is about 50%.

It’s not much different in trading. Every trading strategy comes with a certain win rate and win/loss ratio. Whilst the outcome of any single trade remains a mystery, the outcome over a very large sample size should be predictable and profitable. Probabilities, no certainties.

Image courtesy of https://edgewonk.com/.

Once you’ve come to terms with the fact that you can never really know which trade will win and which will lose, you will have felt a weight being lifted from your shoulders. A weight you have no business carrying, because you cannot foresee or control what the market will do. You can only control your choices in the now and how much money you’re willing to lose if this next trade happens to be one of the losers.

Control what you can and let go of all that is not within your control!

If you risk everything on every trade, you may be able to make a fortune in the perfect set of circumstances, but you will also lose it all (or at least a large chunk of it) once the tides turn against you. And that’s not an IF, rather a WHEN!

Decide upfront on a number or a percentage of your capital that you’re willing to lose if this trading idea doesn’t work and you’re at least partly in control of the situation, knowing your exact worst case scenario.

Never let one mistake, one bad trade, one decision or one event in the market destroy your whole trading or investing account! Never! Protect yourself against all risks to the best of your ability.

Knowing something and truly accepting it however, are not the same thing.

The best way to accept these facts is by experiencing them in the markets. And since these sorts of experiences cost money and take time, you can try to see the validity of it all, by doing back-testing.

Choose your strategy and back-test the hell out of it.

The more markets, the more virtual trades, the more experiences, the better. Journal them meticulously, like you would your actual trading, because you need that data.

Only when you will categorically prove to yourself that being profitable in the markets is indeed just a numbers game, when you’ve seen all sorts of random distributions and periods of extended losses and wins, will you be able to trust your system and accept the losses as part of this game. A necessary part, an integral part.

Paper trading has one huge, insurmountable problem though. We don’t care about virtual money, not really. We can paper trade perfectly like robots and execute our trading strategies, following our rules to the letter, but when real money is involved all that goes out the window. There are no emotional attachments and reactions in paper trading, and those are the ones that get us.

A smaller account (with actual money) is therefore much more impactful. However a combination might be best, especially because the point of this exercise is to prove to yourself that:

your strategies work over a large enough sample size

any strategy will experience a string of losers and a string of winners, but it won’t matter in the end

taking losses is not only necessary, but beneficial in your strategy

you can take a lot of losses in trading and still be profitable on a large enough sample size

All of the above of course depends on your strategy actually giving you an edge in the market and being profitable in the first place.

What are some other ways to help you completely accept taking losses? Allow me to offer a few alternative ways of looking at losses, re-framing them in your mind, releasing any resistance you may feel toward them. You can theoretically push through with only your willpower and discipline, but this it an insanely harder path, fighting an uphill battle all the time.

Every trade makes you money, even losses re-frame

This is a great mental trick that a good friend of mine has taught me. It originated in outgoing sales calls and emails re-framing, but applies to trading as well. I’m assuming that you have been trading for a while and that you have some kind of statistics available for analysis. If you don’t, this is something you should work on. Data is invaluable.

Example (use your stats, of course):

In the year 2022 you made 100 trades.

50 of them were winners, 50 were losers.

The final result was 100,000 USD in trading profits.

Let’s say you lost 50,000 USD on your losers and you’ve made 150,000 USD on your winners for this example (1/3 risk reward ratio).

The losers were just as important as winners in the end, as you wouldn’t have had those winners without the losers, because they are randomly distributed for any edge strategy.

You can now extrapolate that everyone of those 100 trades has made you money in the end, 1,000 USD to be exact in our example; win or lose!

If you are trading a certain trading strategy with a proven edge (you should), then you can now assume that, win or lose, your next trade will make you money. Because in the long term winners will cover the losers and the remainder will be profit.

Now the of losing any single trade is gone, as you understand that all of them are making you money in the end.

In case you’re still fighting this idea of needing the losing trades in order to find the winning ones, think about it this way:

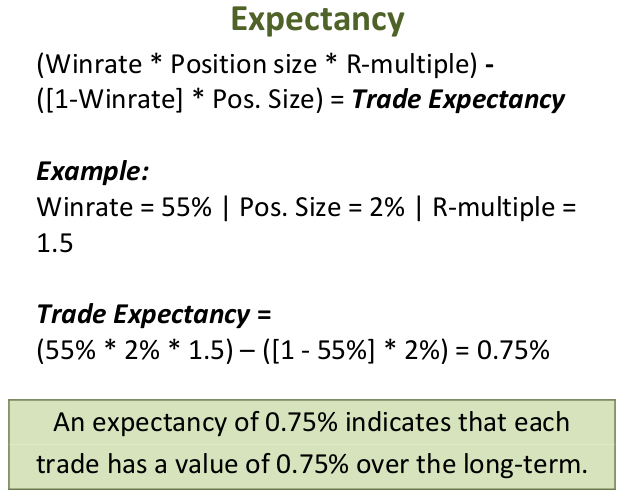

Every trading strategy has a certain win rate (50% for example).

Every trading strategy has losing trades (50% from the above example).

The only way to make full use of any trading strategy (100%) is to play it as often as you can, every time the market gives you the right conditions.

With a 50% win rate and a 2/1 win/loss ratio for example (you risk 1,000 USD to make 2,000 USD), you would now want to take as many trades as you possibly can in order to make as much money as you possibly can!

Losses = business expenses re-frame

You, as a trader, may not have much in the way of material expenses, but you still have to spend money in order to make money.

Only you’re not buying equipment, paper, gas, adds, raw materials and so on, you’re paying the price by taking losses, paying trading fees and taxes. I for one never really found much help in looking at losses in the way of expenses, as I am heavily prone to cutting expenses and saving money in everything I do, but I do know some people who love this mental re-frame. Every successful business has some expenses and when you mentally connect taking losses with business expences, it might just click in you mind.

Stop losses (small losses) are your friends, your protectors re-frame

They are protecting your money from the dangers of the market. They are your friends and their whole reason for existing is to serve you, to protect you.

And yes, sure sometimes they can be overprotective and you end up missing some interesting opportunities, but they help you sleep at night. Allowing you to rest, because you know that they never sleep, always having your back, protecting you from taking on serious damage. They are always there to stop you from doing something stupid and dangerous. Stop losses are then working for you, not against you.

Stop loss as insurance re-frame

You could also simply re-frame automating taking losses as cost efficient insurance against expensive damages.

Yes, you pay a premium, but with it you gain some peace of mind. You now have a fixed expense protecting you against all dangers that prey upon your money, just like you insure your car against hail, accident or theft.

You willingly pay a certain amount upfront in order to protect your capital from a devastating loss. A small price to pay, for a peace of mind, don’t you think?

I hope you like these mental re-frames. I know they made a difference in my trading and I believe this is one of the key areas that separate professional traders, from casual gamblers. Experiment and find what works for you.

So, let us summarize the main reasons why you really do need to learn to accept losses in trading:

Every system includes losses, some of the best systems have quite low win rates, but are still profitable, because the winners far outweigh the losers. If you’re being sold on a trading system that always wins, you’re being scammed!

There can be no wins without losses, if you don’t risk, you don’t play and you can’t win. You have to be willing to take chances and play the numbers game.

If you aren’t willing to take small losses quickly, you will be forced to take big losses somewhere along the way. It’s not an IF, but a WHEN!

If you’re emotionally struggling with accepting losses, trading will be a stressful and dooming affair for you, leading to all sorts of emotional problems and mistakes in the market.

As a general rule, emotions have to be completely eliminated from your trading and that is a feat all on its own. We are after all emotional animals, driven by our wants, needs, fears and doubts. We are plagued by greed on the one hand and fear on the other. There is very little rationality in our behavior and that is all too visible in the markets.

But in trading, emotions cost money. And unfortunately, losing money is the cheapest of possible consequences to allowing emotions near your trading. Stress is a killer and there are very few businesses more stressful than speculating in the markets. Depression, drugs, alcohol and suicide are often the end result of letting your emotions run amok in the market.

The good news is that trading doesn’t have to be stressful. Stress is predominantly self imposed, a product of our mind, not external events. We’ll talk more on that topic in the coming posts so make sure you subscribe and be alerted when new content is published.

Disclaimer: nothing here is financial advice, just a fellow trader meditating on his trading journey, sharing the lessons he learned and debating some personal opinions that are only that, opinions and nothing more.

Trading Meditations Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Follow Trading Meditations on Twitter for more related content.

You can also show your support for my work and buy me a cup of coffee with Bitcoin: bc1qc60qsgtwzhgv3nnxvx6jlsuxh2zh55x3s4fv7w