Accepting Losses in Trading

Are you comfortable with taking losses or are you still avoiding it like the plague? - Mind of a trader series

Nobody likes losing money. No one likes to be wrong. The difference between those who have accepted that taking small losses is part of this game and those who cannot come to terms with that fact, is simply experience.

If you think that taking small losses on your trades feels bad, you’ve never had the pleasure of suffering through a large, soul crushing loss.

Winning is easy. Making money in the market feels fantastic. For all the newcomers in this game, the first big winning streak is like losing virginity. A whole new world opens up to you and suddenly you feel that you’ve got this game of life beat.

I know the feeling. I’ve been on top of that emotional world and it was absolutely enticing. I could do no wrong in the market for the first couple of months. In less than half a year I started making more money per month than I did per year at my previous job.

I started trading full time in the middle of a bull market that went absolutely crazy. In essence, it was one of those “everyone’s a genius seasons”, I just didn't realize it yet. I had only come to know the pleasant side of the market. I was a newborn fly who had only lived in the warm sunny part of the day. The cold night was just a boogeyman, a tale of old men to scare the children sort of thing.

But worry not, everybody that stays in this game will eventually have to go through absolutely horrifying market conditions and times of unprecedented fear and doubt in the markets. That’s if they survive long enough in the first place. One can go broke in a bull market as well, you know.

A trader learns all the wrong lessons in overly bullish conditions and can easily pick up some bad habits. I sure did and I see it in my fellow traders all around the world. Even the ones we would call professionals, hedge fund managers, billionaires, it makes no difference. We all go through more or less the same problems on different scales and we all have to learn the same lessons, if we are to survive in the markets.

One such lesson is that taking losses is unavoidable in trading.

We all have to make peace with this fact, for it is a fact, not an opinion. I will repeat that one more time: every trader has to take losses, no exception!

The smart, experienced ones take them fast and ruthlessly, for they know that

it is the only way to survive in this game and that

the first loss is always the smallest.

There’s a thousand ways to win big in trading and very few ways to lose big. And they’re all essentially about not cutting the trades when you should have and allowing losses to grow out of hand.

The only acceptable outcomes of any trade are:

a small win,

a big win,

a break even and

a small loss.

As you can see, taking a big loss isn’t among them. With good reason.

I have personally struggled with taking small losses while trading for a long time. All of my huge setbacks came from that particular problem. All of them! Every time I lost serious money, it was because I just couldn’t take a loss, even though I knew better.

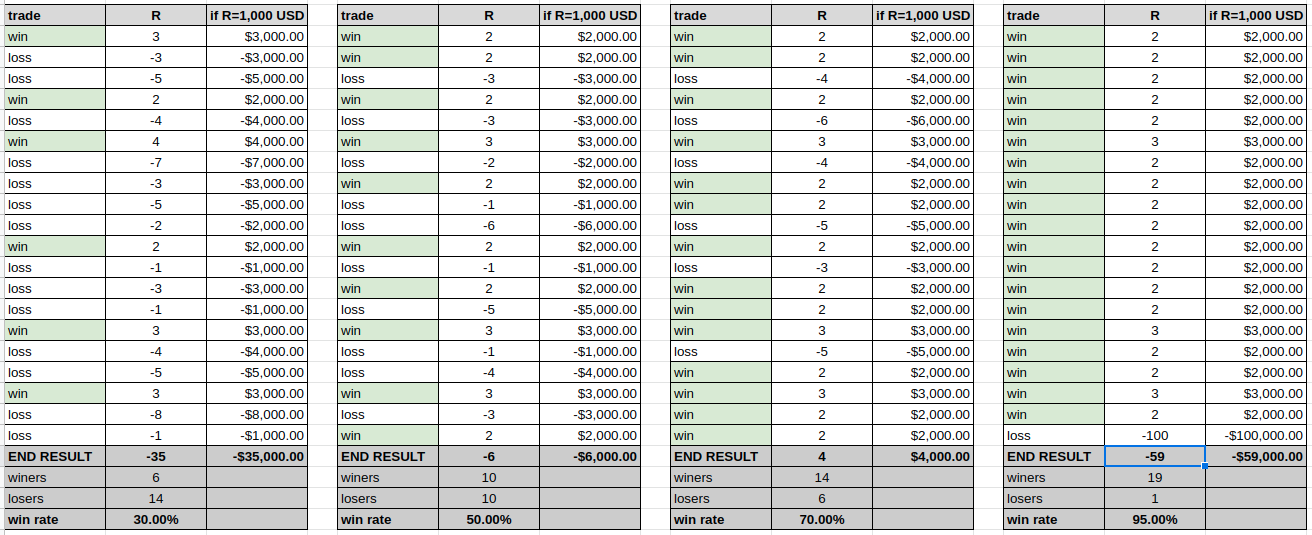

Image courtesy of https://edgewonk.com/. The image above illustrates just how difficult it is to make your money back, if the losses get too big.

When I followed my own rules of risk management, the worst case scenario even with some devastating losing periods, was a small % loss in my trading portfolio. Nothing that couldn’t be fixed in a short amount of time, when I got back in the flow with the market.

Even in periods when I only had a 17% win rate and was completely out of touch with the market, I didn’t lose any significant money trading!

“How is this possible?”, you might be asking yourself.

Most of the time, when I did poorly in my trading I simply didn’t make any money, but I also didn't really lose any either. I won some, I lost some and they sort of canceled each other out. All I was losing was time, but I was gaining valuable experience in exchange, so it was a net positive.

The above examples illustrate that even with an appalling win rate, way below 50% (even 10% as seen above), a trader who manages to keep his losses contained, can still be OK. He or she will survive. R = risk unit, so if R = 1,000 USD, a trader is risking 1,000 USD on every trade. If he wins 3R, he makes 3,000 USD. Risk, not position size! 1,000 USD can be risk on a 100,000 USD position if your stop loss is 1% away from your entry, for example.

Only when I broke my own rules and loosened my risk management, did I ever get seriously hurt. One mistake can wipe you out completely, as I’ve learned a few times by now. I’m a slow learner, I know.

The above examples illustrate that even if you have godlike win rate, way above 50% or even 90% and do not contain your losses to a minimum, you can take on serious damage. One mistake can completely annihilate your trading account! It happens more often that you’d think and when you least expect it!

From my point of view there are only two ways to learn this lesson:

The easy way - learn from people who have been there and done that.

The hard way - go through adversity yourself and lose a lot of money yourself.

The choice is yours, but the lesson will be learned either way.

Let’s talk about why we have such a problem taking losses in trading?

We all have a deep desire, a need to be right.

It feels bad when we are wrong, it feels bad to lose. But in the markets, we cannot always be right. It’s just not possible, nor is it necessary. In fact, being right and making good trading decisions have very little to do with one another.

To make things worse we then somehow associate our being right or wrong, thereby being smart or stupid, with the results of our trading.

We attach our own self value to the outcomes of our trades, which is completely insane.

Winners and losers for any system in the market are randomly distributed. Imagine if you got upset on a coin toss, when you guessed it wrong! How silly would that be?

You’re not smart when you win or stupid when you lose, even though you feel that way! You can never know which trade will work out and which won’t. No one can see the future. No one can predict what the market will do next. Losing a trade doesn’t tell you anything about your intelligence or capability.

In trading everything is about probability, never certainty. A good strategy will give you a slight edge in the markets, but it will never give you certainty. No strategy can do this! If you wish to be a profitable trader you will simply have to find a way to survive the losing trades and bad streaks for long enough, to be able to take advantage of the winners and profits when the market offers them.

The result of any one particular trade doesn’t matter!

What matters is the result of a large sample of trades. 100, 1000 trades, a year or ten years worth of trading. Profitability on a large sample size is the only thing you need to concern yourself with. Everything else is just randomness and chaos at play.

I will repeat this one more time: it doesn’t matter if you win or lose this next trade. As long as you manage risk, of course. Do yourself a favor and read the excellent book “Trading in the zone” by Mark Douglas, which delves deep on these concepts.

Let me ask you this: “Would it really matter if you lost 40 out of 100 trades, if you still doubled your money in the process?”

How about if you lost 70 out of 100 trades, but you still made a fortune in the end? No, right? All that matters is that you end up making money, that you end up with profit. This is the essence of trading, my friend. Every trader needs to make peace with taking small, controlled losses by protecting him or herself on every trade. There are many ways to go about this, but managing risk is your number one priority!

Failing to do so will only lead you to one outcome - failure as a trader, large losses, liquidated accounts, broke and on the phone calling your old boss for your job back!

Now that you know what you must do:

learn to willingly accept small losses as part of your trading and

stop fighting them as that only leads you down a dark road.

How exactly does one go about achieving this mentality?

Subscribe and be on a lookout for the next post in the series, where I’ll offer you some great suggestions on achieving just that. Not only will you then be able to stop resisting taking small losses in trading, you’ll see them as a good thing, as your friends. Don’t believe me? Stick around and find out.

Disclaimer: nothing here is financial advice, just a fellow trader meditating on his trading journey, sharing the lessons he learned and debating some personal opinions that are only that, opinions and nothing more.

This newsletter is supported by you, dear readers, no one else.

I invest a lot of time and effort into writing this content and I do not get payed for my work. If you enjoy reading this newsletter and would like to support my work you may do so in one of the following ways:

- Share this content.

- Become a free or paid subscriber of the Newsletter.

- Become my Patron (tip jar)

- Buy me a cup of coffee with Bitcoin.

Bitcoin wallet: bc1qc60qsgtwzhgv3nnxvx6jlsuxh2zh55x3s4fv7w