Market - The Great Trickster, Part 2/2

Pump and dumps,news FOMO, and order book tricks. Can you trust the information on the internet? How about your own eyes?

This is part two of a two part post titled Market - The great trickster, where we talk about a few ways in which you are being played by the market or whoever that entails. It’s no different to magic tricks. Once you know how they’re done, they loose their power over your perception. The magic may be gone, buy your money stays with you.

If you hadn’t already, please read the first part before continuing, where I explained how to spot and trade Liquidity pools, stop hunts and fakeouts, that just happen to be one of the more important trading strategies I employ in my own trading.

Now we can move onto some other games the market participants are playing and involve some trickery.

Pump and dumps

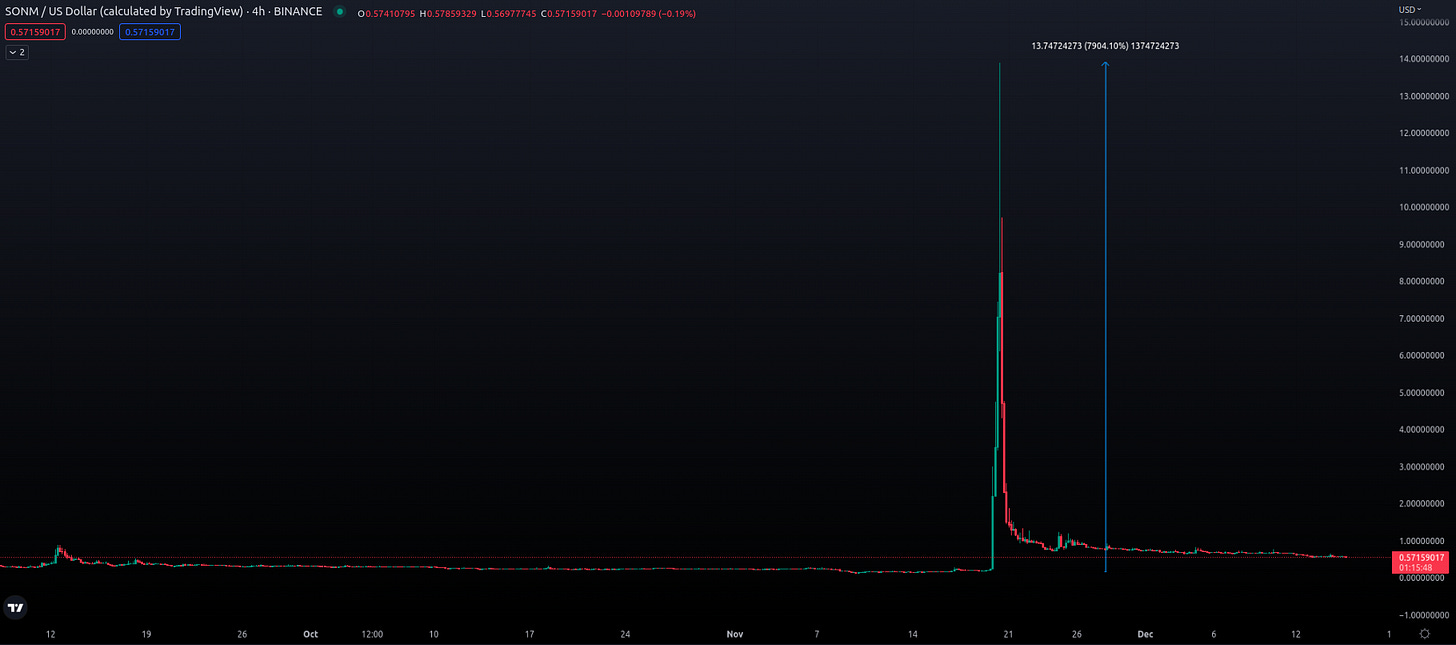

We talk about “pump & dumps” when a low liquidity instrument goes bat shit crazy, pumping hundreds of percent in a matter of hours or days, before dying completely and ending up lower than it started. This is where a few people make money on small obscure alts and where the majority of retail losses theirs.

It’s a particularly ugly game some people play and it is well documented to often be the work of organized groups manipulating the market.

To go all conspiracy theory on you, “they” - the evil cabal of pubescent geeksters, sometimes encouraged by their seductive brethren from the financial circles, will organize in groups with the intent to pump the price of some illiquid instrument (like a shitcoin) and fool the rest of the market that it’s the next best thing, until everyone and their uncle is pouncing on the opportunity, pushing the price into stratosphere. As you can imagine, there are many interested parties for such activities, especially in Shitcoinlandia, where imagined value is created out of thin air.

Somewhere along the line the original tricksters will have sold, leaving the poor naive sods to hold bags full of worthless shit, helplessly watching as all their money flushes down the drain.

After they’re done celebrating their newest scam and post an obligatory picture of hot girls and Lambos on Instagram, they’ll simply move on to a new thing and start all over again, finding a fresh batch of hungry little fishes fueled by dreams of endless riches and herding them to the slaughterhouse. And round and round we go. Rinse and repeat, always a new batch of fresh idiots to exploit. This particular pattern will be especially visible in a myriad of obscure, low liquidity altcoins.

In case you now find yourself scratching your head, wondering “did I screw up holding my bags”, the answer is probably yes. Congratulate yourself, you got played. Sell that shit, take the loss, wash your hands and be done with it. The vast majority of these completely unnecessary scams we call altcoins are going to zero. It’s only a matter of time.

What is a trader to do with this information?

Stay away from low liquidity altcoins, especially when they pump vertically. It’s better to just send money to your local animal sanctuary and do some good with it. Feed a hungry scarred little dog, not a horny evil scammer.

If you insist on playing with these pumpy shitcoins then at least stick to quick “smash and grabs”, and play only with money you’re willing to just light up and watch burn just for the fun of it.

Is there really no way to make money in this particular game of the trickster?

Sure there is. The easiest is if you join one such a group, sell your soul to the devil, fuck up your karma and become one of the most hatted individuals on the planet. No? Not interested? Good. I’m proud of you.

All right, you seem like a nice person. I’ll throw you a bone, hoping that you’ll be able to satisfy the itch you feel when you’re watching those giant green candles, mistakenly thinking “everybody’s making money but me”, consumed by irresistible FOMO. We’ve all been there.

First a warning. No, shorting is not the way! Because predicting how high these fake and forced moves can go is next to impossible. If you choose to short them nonetheless, wait for some structure to form in order to give you a basic idea of where to enter and where to exit.

The easiest way you can participate in this particular game is by playing the pullbacks. When you notice a giant green candle, preferably supported by a large increase of volume, wait for the first pullback, buy it and sell as it pumps again.

A few things to keep in mind:

The first pullback is by far the safest, but sometimes you’ll get away with a few more.

Enter at roughly 50% pullback. You can also layer some orders along the green candle, just be prepared to cut the trade if it starts to get ugly.

Don’t be greedy here, take profit as it’s given. I would suggest before reaching the previous top of the dildo candle, to be safe, depending on the strength of the move.

If the move has stalled and lost its steam, get the hell out! There is no organic growth here, these are scam moves that get retraced more often than not.

Never risk a lot of money on these, they’re very high risk and practically impossible to protect with stops as they span tens or hundreds of percent in price change. You have to play them “naked”, which means peanut size only.

If you do decide to put on a stop, do it far away from the action. These price actions are extremely volatile and unpredictable.

When the Bitcoin chart is practically dead, with extremely low volatility, it’s a good time to scan around the trashcans of altcoin charts to see if any is still alive and kicking.

Just make sure you understand that you’re playing with fire and all of these moves have a very short and volatile expiration date. Don’t think of them as making money, more as passing the time curbing your FOMO, so be conservative with size.

Warning: failure to get out of such a trade as soon as something goes awry will result in large losses and involuntary bagholding. Avoid it at all costs!

News articles and public opinion manipulation

First of all, contrary to what you may believe, you cannot reliably trade the news or events. You just can’t. The assumption that the markets are rational is false! If anything, “buy the rumor, sell the news” is the better of the two approaches. Everybody falls for this idea of being able to trade the news and bigger events, but ultimately learn the hard way that markets are irrational and that anything is possible, which includes even the most illogical reactions to any news.

Not to mention that by the time the news has hit the streets and everybody hears about something, the insiders have already made their moves, the proper play had already been played. The retail are late to the party and are usually the ones paying the bill in that trade.

To add further insult to injury, if the price moves in correlation with the news, it tends to be a short lived move and a retracement is likely to follow. You’ve been warned.

Below is an example of the notorious 2017 China FUD and what came out of it. I was there, trading this live and let me tell you, at the time this felt like a market changing event! The FUD was real.

Link to the article that the first screen is here.

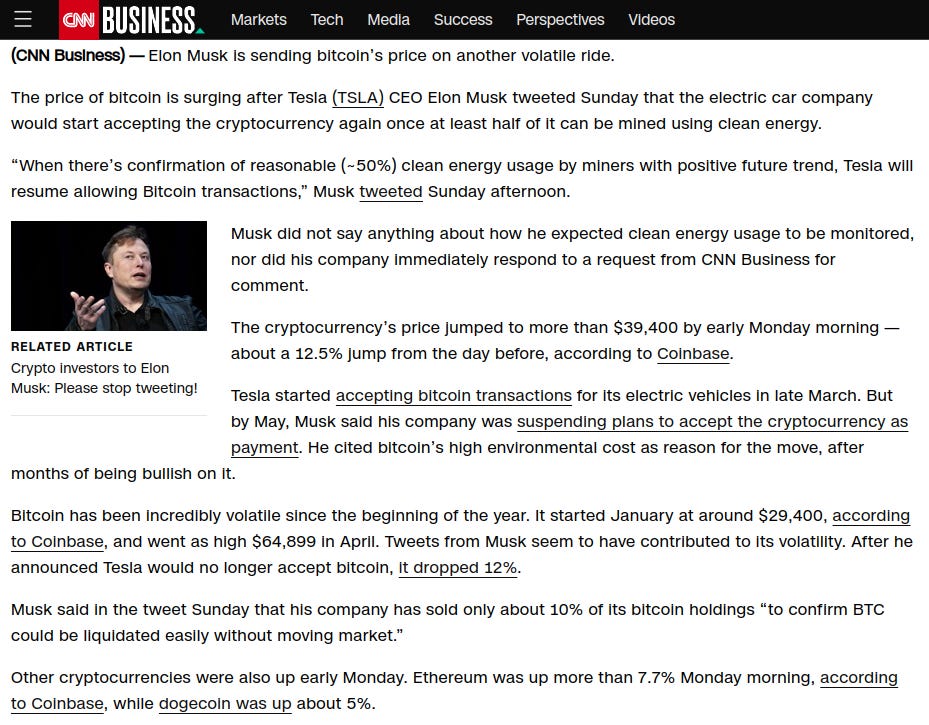

News driven FOMO has about the same life time expectancy. Here’s one of the more obvious examples, when Tesla hinted the possibility that they could start accepting Bitcoin in June 2021. Link to article is here.

Here’s a more recent example, one that people were screaming out of their longs would be a catalyst for Ethereums rise to the top and moon shot or whatever. I’m not saying it’s not a giant technical achievement, I’m just pointing out that the narrative of this news being an immediate driver of price rising into the stratosphere has once again been proven as false. Article can be found here.

Of course there are exceptions to this rule as well (Saylor buying in 2019 comes to mind), but for the most part news or announcement driven market moves are short lived and retrace fully sooner or later. If the news coincides with corresponding market conditions (FUD in a bear market, FOMO in a bull market) they can indeed accelerate the price movement.

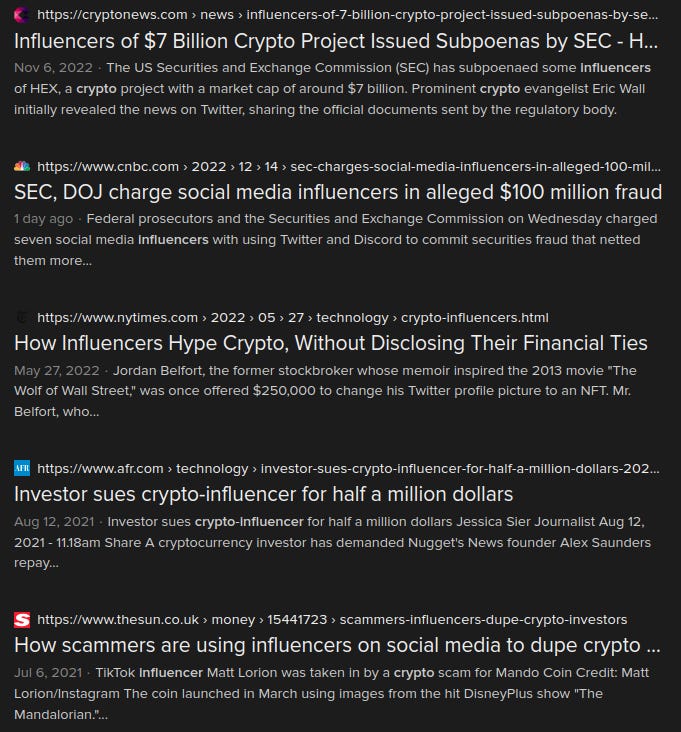

There is a lot of money to be made by manipulating the markets and there are a lot of incentivized individuals for such nefarious activities. From investors, pump and dump groups, large holders, VC-s, project founders, influencers and so on. In smaller, less liquid markets, news or even just loud individuals with larger followings can move those markets significantly, which gives people with money a vested interest to manipulate the information that is being released. My point is simply this - do not believe everything you see on the internet at face value!

Pay special attention to anything your favorite influencers are trying to “sell” you or rather just ignore them completely. It’s been proven again and again that they routinely somehow “accidentally” forget to disclose that they either got paid for the shill (marketing, ads, sponsors) or got dibs on seed rounds in the starting phases of the project launch.

Do not count on them to be honest with you and just realize that they too, know nothing about the future, despite screaming “moon” at the screen all day long. The more they try to push some narrative, the more they scream, rejoice or fake enthusiasm in some other way, the more suspicious you should be getting. If someone is exceedingly enthusiastic about some stock, coin or project, chances are overwhelming that he or she has a financial interest in the success of that thing. Do with this information what you will.

Still not convinced that predicting the future is not possible or necessary to make money trading? I wrote a whole post on the topic and I invite you to delve deeper with me here.

Order book spoofing

We all like to check up on the order books for any signs of obvious big buyers or sellers. It makes us feel like we’re being offered a look into the depths of the ocean, seeing all the small and large participants and their bankrolls. They often appear in the form of large orders that stick out of the order books, like a sore thumb. It can be useful to see those and be wary of their presence, like you would be wary of a large great white shark in your vicinity.

But do not rely on that information for actionable data points, because very often these large players will be playing mind games in the order books. You will see them in the form of large sell or buy walls that keep moving around, never really getting accumulated.

If that someone wanted to actually sell all his coins for example at that price, he or she would just stay there and let the little ones nibble away until he was done. It’s not easy separating fake walls from real ones, so just keep in mind that just because there is a wall at a certain price range, no matter how impregnable it may appear, that does not mean that price cannot get through. That sort of thinking will give you a false sense of security and it will bite you in the ass.

More often than not these orders will continually disappear and reappear, indicating they’re there just for theatrics. A scare tactic, if you will or simple herding of traders in to desired directions. Do not be a sheep, be a wolf!

Besides, large whales know how to hide in the order books and trade in millions without leaving a trace, by dividing their orders into multiple small ones or simply disguising themselves at the most populated price points. If you’re seeing their handiwork, it’s no mistake!

In short: “do not believe your eyes, they are deceiving you”!

Drawing chart patterns as bait

This whole post is getting a little long, so I will leave you with one short legend that scares little children around these parts. It is said that the big whales, sharks and other monsters that prey upon the innocent in the markets have a good understanding of their prey and their habits. They know the patterns in the charts that the little ones search for, so they are rumored to paint them for their eyes to see.

Image source: https://www.forex.academy/forex-chart-patterns-might-be-an-illusion/

They can paint any picture they want, if they have enough money and incentive and no one could be the wiser. They know that you’re looking for triangles, head and shoulder patterns, engulfing candles, breakouts and all other sorts of text book charting patterns and they use them as bait, giving you a false sense of security, before revealing their true intentions and eating you alive! Think of the old wolf in grandma's clothing, baking cookies and welcoming the little girl with the red cape to dinner. Only she’s not coming for dinner - she is the dinner!

Don’t be the meal, dear reader, be the predator or at least the Remora with a parasitic relationship with her large predator. (small fish that stick to sharks)

Disclaimer: nothing here is financial advice, just a fellow trader meditating on his trading journey, sharing the lessons he learned and debating some personal opinions that are only that, opinions and nothing more.

This newsletter is supported by you, dear readers, no one else.

I invest a lot of time and effort into writing this content and I do not get payed for my work. If you enjoy reading this newsletter and would like to support my work you may do so in one of the following ways:

- Share this content.

- Become a free or paid subscriber of the Newsletter.

- Become my Patron (tip jar)

- Buy me a cup of coffee with Bitcoin.

Bitcoin wallet: bc1qc60qsgtwzhgv3nnxvx6jlsuxh2zh55x3s4fv7w