Manage Risk on Every Trade - No Exceptions!

Don't let one trading or investing mistake ruin you and set you back years. Do you manage risk and protect your money on every single trade? You really should!

“I have two basic rules about winning in trading as well as in life:

1. If you don’t bet, you can’t win.

2. If you lose all your chips, you can’t bet.” — Larry Hite

Welcome to another cautionary tale spilling onto the keyboard from this scarred-up trader. This will be one of those: “don’t be like Mike” sorts of articles. I hope that by writing on the dangers of this game, exposing my stupidity and naivety, I would have saved at least a few lucky bastards some of your hard-earned money.

Now that we’ve firmly established that you will lose in this game and you’ve given up on the idea of a perfect trading strategy that only wins all the time, we can get down to managing your risk on every trade. I struggled with this in the first few months and years of my trading life.

I don’t need risk management - I never lose!

When I started, I learned a trading strategy with a very high win rate, and I rarely lost money trading that strategy.

I felt like I had this game all figured out. I could see this pattern repeating on every chart I looked at, crypto, gold, stock, and indexes. It didn’t matter. Everything was so clear to me. It was so simple, so beautiful, so natural. I understood it, felt it, and clicked with the markets instantly. It did seem like the holy grail of trading. I practically couldn’t lose.

It gave me a false sense of security and certainty. But that was just an illusion. For those things don’t exist in the world of trading.

Even though this trading strategy almost always wins, it has one deadly flaw. It’s nearly impossible to manage risk when trading this system. The more wrong you are on your trade, the more you double down until you run out of bullets. And then you wait for the market to correct the exaggerated move you faded.

Yes, you guessed it, I was a knife-catching specialist.

The bloodier the streets, the bigger the panic in the air, the scarier the FUD, the more fun I had, and the more money I made. Once I fully trusted the system, I went all in every single time.

Boy, was I on a roll! Until one day, I got caught in one of those 1 in 100 possibilities, a coin that just wouldn’t go back up, ever.

I couldn’t resist loading up on a falling brick of a coin that just looked like such a juicy opportunity. I had to pounce on this easy prey and went all in. Not all at once, oh no, I was trying to be smart about it, but in a few weeks, I was a certified involuntary bag holder. All I thought about was how I would spend all this extra cash, bloody idiot.

I’ve been winning for over eight months straight, juggling those knives like a circus freak, before I got cut so severely that I never fully recovered. One overwhelming mistake was all it took to set me back for years. Like I said, don’t be like me.

Protect your money always - no exceptions!

I don’t care how sure you are of your idea, project, coin, or strategy. Anything can happen at any time in the markets! Deal with it. Embody this philosophy. Breathe with it. Become one with uncertainty. Always be prepared for the worst-case scenario. Remember, all it takes is one bad mistake, and you’re out!

Now that we’ve got that self-exposing cautionary tale out of the way, we can get down to the how. We’ve already covered how to manage your whole portfolio, most notably only to trade a small portion of your entire portfolio and to be wary of third-party risks. We went through some of the biggest threats that prey upon the unsuspecting trader, and now we’ve come to managing risk on every single trade.

How much do I risk?

The first thing you need to do is come up with a number or a percentage of your trading portfolio that you are willing to risk on this (or any) trade.

Ask yourself, how much money am I willing to lose on this trade if I’m wrong?

I won’t preach to you about that number, as it heavily depends on your pain tolerance, budget, and trading strategies. Just be aware that there will be times when you will stack up consecutive losses in a row. Statistically, 5-10 is not unusual, but there’s no rule it has to end there. I’ve just burned through one such horrible string of losses—twelve and counting. The difference is - this time around, it doesn’t matter!

While I would have been down and out in the old days, I’ve barely got a scratch to show for it today!

I would say that it’s essential that you can survive at least ten consecutive losses without making too big a dent in your portfolio or, even more importantly, in your mindset.

Will you be able to take that loss? Mentally.

Will you be able to close the trade and stay unaffected by it?

Will you be able to handle two or three losing trades in a row and continue to trade your edge strategy objectively?

How much damage will your trading portfolio sustain if you lose eight times in a row?

Only you can answer these questions for yourself, but answer them you must!

Shut up and show me how!

Here’s how you can calculate the size of your trading position based on your risk parameters.

This part is easy if you decide upon 1% of your trading portfolio.

Simply use this formula: (trading portfolio) x 0.01 = XExample: 10,000 USD (your trading portfolio) x 0.01 = 100 USD.

You can now risk 100 USD per every trade you open. Simple.

Now you have to calculate the size of the position you can open.

Look at the chart and decide where you will put your stop loss or where you will get out of the trade if you’re wrong. Some exchanges will automatically calculate potential loss and profit (Bybit, for example), saving you the trouble. Use Google spreadsheet or Excel to automate the calculations for all other cases.

Let’s say you want to get out of the trade 5% below your entry point. This is where you’ll be placing your stop. Now we have two data points, your desired risk of 100 USD (or 1% of your trading portfolio) and the distance to your stop loss position of 0.05 (5%).

To calculate the maximum size of the position you can now open, use this formula:

(risk per trade) / (distance to stop loss) = y (position size)In our example, that would look like this:

(10,000 x 0.01) / 0.05 = 2,000 USD or simply 100 / 0.05 = 2,000 USD.

You now know that you can open (buy/sell) a 2,000 USD position, and with a stop loss 5% below your entry, your loss is contained to 100 USD. It doesn’t hurt to consider some fees and possible slippage and round that number down.

As we have now calculated the maximum size of any position you can open, the rest is relatively simple. Even when using leverage, just make sure that the position you opened, however you got to that number, isn’t bigger than 2,000 USD, and you’re safe.

You can read more about trading with leverage and using it to manage risk in this article.

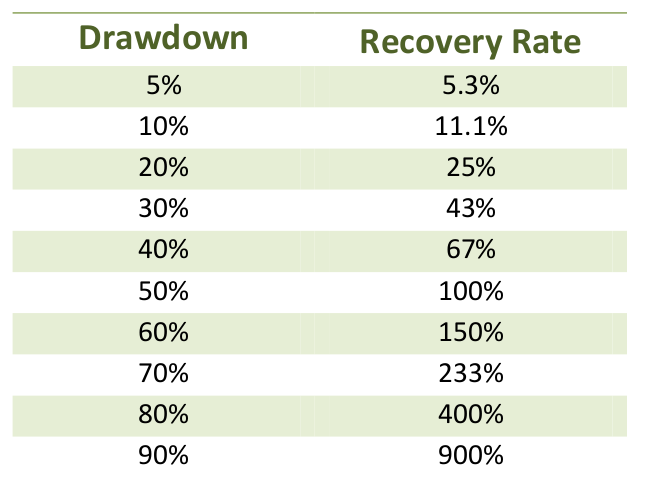

Remember, losing money is easy; making it back is a whole other game.

There are many ways of managing risk.

The simplest way is using a stop-loss order for every position you open.

It can be a mental stop, meaning that you decide up front on a point at which your trading idea is invalidated (why you opened the trade), and get the hell out manually, but I wouldn’t recommend it. It takes impeccable discipline to cut trades in the heat of the moment.

Should you set up a limit or market stop loss? My advice? Market! Always. Too much can go wrong on a limit order. Slippage and fees are the least of your problems when things go haywire in the markets.

Never remove your stop loss order once it’s placed. Chances are that your mind is being compromised either by fear or greed. You’ve put it there for a reason.

I would advise against trading naked - without protection. That is how bagholders are born every season. Traders who, against their will, become long-term investors. If you need any other encouragement for managing risk in your portfolio and every single trade, know this one glaring fact about this industry:

The one mistake we all make!

Every single trader and investor that has ever failed miserably and lost all of their money, did so because they failed to manage their risk!

Eliminate this problem by always diligently managing risk, and you’re already ahead of 99% of all trades in the long run.

Always set up a plan for your trade before you open a trade.

When your mind is fresh, and your view is at least slightly objective. And stick to it. Remember, you’re smartest when unattached. Once you’re in a trade, all objectivity will be lost, and emotions, strengthened by new biases, will be prevalent in your thinking.

If you struggle to see this point, here’s an example. If you’re happily married and love your wife, you probably don’t want to cheat on her. Right? So it’s best to avoid getting into situations where your faithfulness will be tested.

Not going to the other girl’s apartment for a quick drink. Not staying too long at your company’s party so that everybody’s drunk and horny and climbing all over you. You may be able to stay strong and say “no” to a hot ass while in public, sober, and in daylight. But how strong are you really if you’re left alone with her, in the middle of the night, on the other side of the world, with her legs wrapped around your face?

My friend, those demons will be hard to keep at bay once you’re halfway to the forbidden land of untold lust and pleasure, her panties across the room and her breath fogging up your neck! Or in terms that single men would understand. You always put armor on your soldier before you enter the cave of hidden treasure, not after when the beasts of ecstasy are already upon you! Your faith is sealed at that point.

Trading isn’t all that different. We make the best decisions when we’re on the sidelines, not in the middle of the fight!

Of course, stop-loss orders aren’t the only way to manage your portfolio and trading. You can conservatively manage your trading positions and play much smaller, or you could, for instance, hedge your positions. The latter entails more understanding and risk; the former might reduce your profits. But all of it depends heavily on your style of trading and personality.

We’ll be looking at how best to use stop loss orders in your trading and how to manage risk if you don’t want to use stops in another article, so subscribe below. Congrats on making it this far. I know math is boring, and discussing risk is even more so.

However you decide that you want to manage risk, do yourself a favor, and protect yourself somehow. Don’t let one wrong decision or one lousy trade ruin your portfolio, as I did.

Remember kids: “Don’t be like Mike”!

Sharing is caring, especially in the online digital world.