Is Bitcoin Top In, And Does It Matter?

I’m seeing calls that the Bitcoin and Crypto bull market is over, and people are panicking again.

I do not believe the top is in, but it might be nearing

A lot of FUD (fear, uncertainty, doubt) is currently circulating, ranging from weaknesses in traditional markets to the US government selling billions of dollars worth of bitcoin. Then, there’s Trump and his provocative statements regarding geopolitics.

These could be the cause for the current volatility, but it won’t do you much good speculating on the “why.” Under the line, there were more sellers than buyers. Keep it simple. The markets are often turbulent this time of year, regardless of current theories.

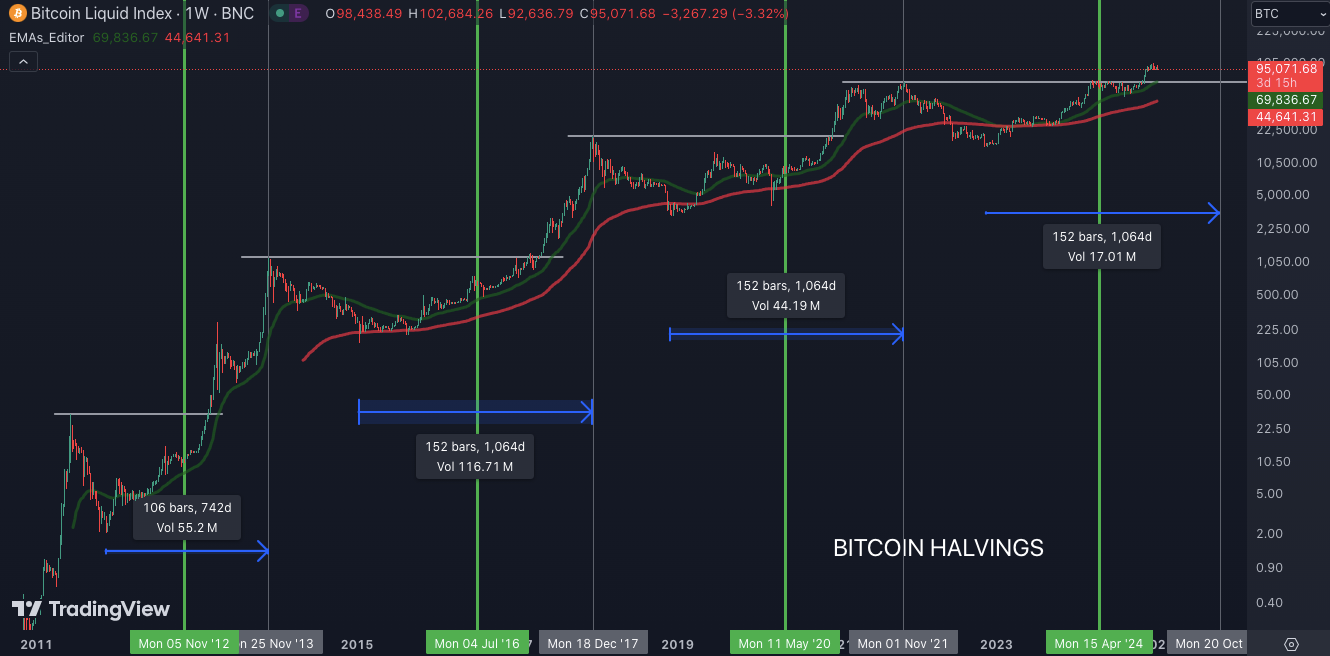

For now, I’m working with the usual four-year cycle theory until I see evidence to the contrary. This cycle is different, though. I see a maturing market with shorter and shallower peaks and valleys closely correlated to the legacy markets (stocks).

There has also been no full-blown altcoin season so far. Select sectors, like meme coins and AI-related coins, have experienced substantial up-and-down swings, but the altcoin sector as a whole has underperformed. Here’s a smelly example:

If we look at our four-year cycles, we’re still in the bull phase, somewhere before the final and most violent pump. However, this is not guaranteed to play out! Violent dips and prolonged consolidations are all part of a bull market.

Lower time frame outlook for Bitcoin

First, let’s clear something up: I don’t make predictions. I am a risk manager, not a fortune teller!

Anything can happen at any time in the markets and in life. You must always be aware of this and protect yourself by keeping an open mind to possibilities.

Bull market or not, the trend has changed direction on smaller time frames. Until we see strength in the charts, a new lower low is to be expected.

There is also a gaping price inefficiency that is just waiting to be retested. Does it have to be? No, but the price may drop there sooner or later.

As scary as that looks, and the carnage it would bring to the altcoin space withstanding, 20-30% dips are normal for Bitcoin.

I see two probable scenarios for Bitcoin at this point

My working thesis is that we are in an accumulative range, and since we tapped to the upside, we will likely tap the downside as well.

There’s also the danger of a deeper pullback, perhaps derived from a head and shoulders pattern we like to draw, landing us right in the before-mentioned untested area.

Black swan or apocalypse scenario

Let’s not forget the tiny, almost non-existent chance that this was indeed the top of the bull market and that we are now entering a bear market. So, how the hell will we survive this option if it comes to fruition?

The answer is not sexy, it’s not rocket science, but neither is good trading. We will survive it by managing risk!

How can we manage the risk of such an event?

We remain aware of the possibility, never exposing our whole capital to the risk of total ruin. “It can’t happen, it can’t go lower than, I know what will happen next…” are all illusions that may prove false.

We take profits on the way up. Ideally, we also remove some of the capital from exchanges. Never be too greedy. When the trend ends, 99% of people give their profits back to the market!

If we go all-in, get caught naked (no protection, stop losses, hedging, etc.), and it gets gruesome, meaning the odds of the bull market being over become high, we get the hell out on the first significant bounce the market provides! This is called the dead cat bounce, and it’s our savior if we only survive long enough to see it.

If we are playing with fire (buying the dip) on leverage, we must also be ready to open a hedge short that will maintain our margin requirements during peak volatility! I do not recommend trading using leverage unless you know what you are doing.

Here are a few examples of dead cat bounces:

While the exit pump or dead cat is often a possible saving grace for people who blindly buy any dip, it doesn’t have to occur, and more importantly, one must recognize that the party is over and get the hell out with a loss.

Most people can’t do that. Can you? Here’s a rule to remember:

If the price has surprised you and you entered too soon, get out as quickly as possible, and recess the situation with new information and a clear head. You can always reenter the market, just don’t sink with the ship. Survive!

Here’s an example of how a possible dead cat bounce could look like in our situation

WARNING:

Altcoins often don’t give you the same reliable chance to get out, and you end up “bag holding” for infinity, praying that one day, your coin will return to the casino and someone out there will pump your bags! Be careful when playing with altcoins. I speak from experience! Some of them never recover.

So, do we need to know the future to make money?

No. We place our bets, calculate our risk and odds, and adapt to the markets as we go. First, we ensure our survival. The “thrive” part will come later.

Right now, I’m looking to reenter the market, and if I enter too soon, I will look to exit and get back in lower. Going down with the ship is not an option for me, so when the market is suspicious, I go into full-on risk manager mode, carefully exposing myself to risk while keeping one eye on the exit at all times.

The most important fact you must accept when playing in the markets is that the future is unknown and that anything can happen at any time. This will keep you open to changes and always prompt you to manage risk.

Now, let’s see if we get some discount or if we will have to chase the price higher again.

Good luck